www.belk.credit.com – How To Check Free Credit Score With Belk Credit

Check Free Credit Score With Belk Credit

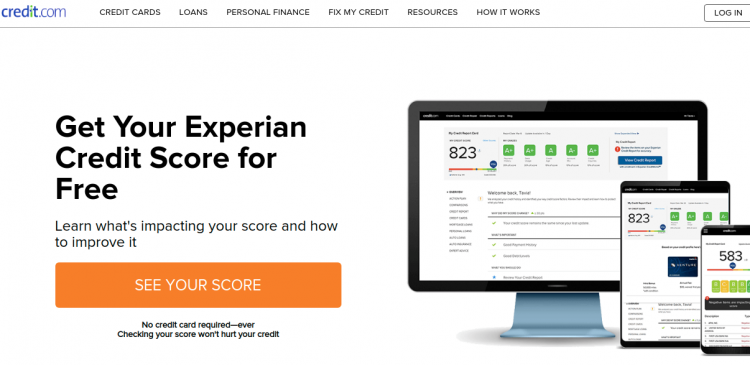

Belk Credit offers a free Experian credit score, free report card and comes with the customized offers & loans. In order to check the credit score, customers do not require their credit cards. Once the customer knows their credit score, they will receive expert advice on how to improve the credit score.

How to Check Free Credit Score

It is very easy to check the free credit score. You may face some problems for the first time. In that case, you can follow these instructions to complete the process:

- First, you have to visit this link www.belk.credit.com

- Then, you have to click on the See Your Score.

- To check the credit score, you have to sign up first.

- Enter your email on the first field.

- Enter the password in the text field.

- After that, you have to click on the Next button for further instructions.

- Then, enter your first and last name.

- Enter your birth date.

- Enter the street address.

- Enter apt, unit, suite, etc.

- Then, enter the zip code.

- After that, enter a phone number.

- Agree with the terms and conditions.

- Then, you just have to click on the Next button.

- Enter your SSN and then, click on the Next button.

- After that, you need to follow further instructions to complete the process.

What Is a Good Credit Score?

The credit bureaus consider any credit score over 650 is a good credit score. Basically, credit scores are calculated using the FICO score or VantageScore 3.0 scoring models range from 300 to 850. As for the FICO score, a good credit score is 670 to 739. For the VantageScore 3.0 scores, 700 to 749 is a good credit score and score from 750 to 850 being excellent.

How Credit Score Calculated?

You may check the free score almost instantly. But figuring out just how credit scores a being calculated, isn’t that simple. It is easy enough to figure out the credit scores. You will get all the information on your credit report.

Payment History:

Your payment history is one of the largest influencers of your credit scores. It depends on the record on your credit reports of whether you pay your bills on time or not.

Debt Usage:

Credit Score also depends on the amount of debt you carry. It making up roughly 30% of your scores. If you have a small amount of debt won’t damage your credit score.

The Age of Your Credit:

Credit scores also depend on your account’s age, not your age. How long you have managed credit is determines your credit score.

How to Improve Your Credit Score

You follow these methods to improve your credit score:

Make Sure Your Credit Reports are Accurate:

To improve your credit score, you should check your credit reports. Everyone has three credit reports. One of them from 3 major credit bureaus: Experian, Equifax, and TransUnion.

Pinpoint What You Need to Improve:

If you having an error on your credit report, that doesn’t mean it’s causing you to have bad credit. If a misspelled version of your name appears in the credit report, that also does not cause your credit score to dip.

Create a Plan to Improve Your Credit Score:

If your credit report information is accurate and you want to improve it, you have to make an action plan using your free Credit.com account. There you can see how that plan impacts your credit scores over time.

Fix Your Late Payments:

Your late payment won’t disappear if you close the account. Here, your best choice is to get yourself back on the right track. You have to pay your bill before the due date alerts with all your credit cards and loans and get organized.

Build a Strong Credit Age:

If you have a short credit history, there you cannot do anything to improve your credit score quickly. In that case, you could try to piggyback on a friend or family member’s credit card, if they have a long payment history.

Get a Credit Card:

If you don’t have any credit card before, then your score may be suffering. You should also know that a new credit card account with a bad payment history will also hurt your credit score. So, improve the credit score, pay the credit card bill before the due date.

Right now, Credit.com does not have a large support team. That’s why they don’t have the capacity to rake customer support calls, unfortunately. But you can email them at support@credit.com.

Reference Link